The Greatest Guide To Stonewell Bookkeeping

Table of ContentsThings about Stonewell BookkeepingThe Definitive Guide for Stonewell BookkeepingThe smart Trick of Stonewell Bookkeeping That Nobody is DiscussingOur Stonewell Bookkeeping StatementsStonewell Bookkeeping Things To Know Before You Buy

Right here, we respond to the concern, how does bookkeeping aid a company? In a feeling, audit publications stand for a photo in time, yet just if they are updated usually.

It can additionally deal with whether or not to increase its own compensation from clients or clients. None of these verdicts are made in a vacuum as factual numerical information should buttress the financial decisions of every tiny company. Such data is put together via accounting. Without an intimate understanding of the dynamics of your capital, every slow-paying client, and quick-invoicing financial institution, becomes a celebration for stress and anxiety, and it can be a tiresome and tedious task.

You know the funds that are offered and where they drop short. The information is not always good, yet at least you know it.

The 4-Minute Rule for Stonewell Bookkeeping

The puzzle of reductions, credit ratings, exceptions, schedules, and, of training course, fines, is enough to merely give up to the IRS, without a body of efficient paperwork to support your claims. This is why a devoted bookkeeper is invaluable to a local business and deserves his/her king's ransom.

Those philanthropic payments are all mentioned and come with by information on the charity and its repayment details. Having this information in order and around allows you submit your income tax return effortlessly. Remember, the federal government does not play around when it's time to file taxes. To be sure, a business can do every little thing right and still go through an IRS audit, as numerous already know.

Your company return makes cases and depictions and the audit focuses on validating them (https://issuu.com/hirestonewell). Excellent accounting is everything about connecting the dots between those depictions and truth (Accounting). When auditors can adhere to the info on a ledger to receipts, financial institution statements, and pay stubs, to call a couple of records, they rapidly discover of the expertise and integrity of business organization

The 8-Minute Rule for Stonewell Bookkeeping

In the exact same method, haphazard bookkeeping contributes to stress and anxiety, it additionally blinds local business owner's to the potential they can realize over time. Without the details to see where you are, you are hard-pressed to set a destination. Only with reasonable, thorough, and valid information can an organization owner or administration team plot a program for future success.

Organization pop over to this web-site owners know best whether a bookkeeper, accounting professional, or both, is the appropriate remedy. Both make crucial payments to a company, though they are not the same occupation. Whereas a bookkeeper can gather and organize the information needed to support tax obligation prep work, an accounting professional is much better suited to prepare the return itself and actually evaluate the revenue declaration.

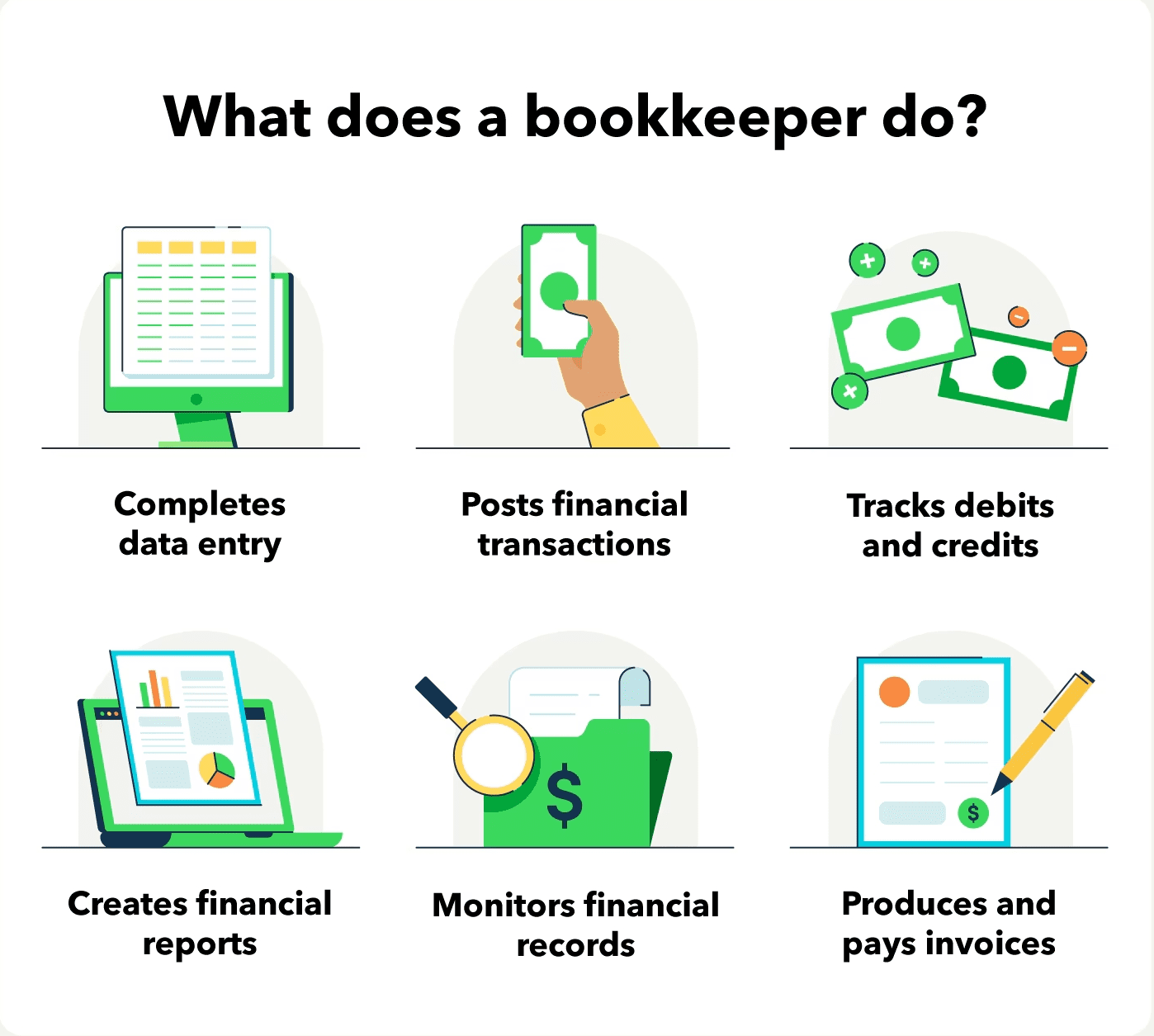

This write-up will look into the, including the and how it can benefit your company. We'll additionally cover how to get started with bookkeeping for a sound monetary ground. Accounting involves recording and arranging financial purchases, including sales, acquisitions, payments, and receipts. It is the procedure of keeping clear and concise records to ensure that all monetary information is quickly available when needed.

By consistently upgrading monetary documents, bookkeeping aids organizations. Having all the economic info conveniently accessible maintains the tax obligation authorities satisfied and protects against any last-minute frustration during tax filings. Normal accounting makes sure well-maintained and organized records - https://experiment.com/users/hirestonewell. This helps in easily r and saves businesses from the stress of looking for files during target dates (franchise opportunities).

The Buzz on Stonewell Bookkeeping

They likewise desire to understand what capacity the business has. These aspects can be easily taken care of with accounting.

By maintaining a close eye on economic records, businesses can establish practical objectives and track their progression. Normal bookkeeping makes sure that services remain compliant and prevent any penalties or legal problems.

Single-entry bookkeeping is simple and works ideal for small organizations with few deals. It does not track assets and obligations, making it much less extensive contrasted to double-entry accounting.

Not known Facts About Stonewell Bookkeeping

This could be daily, weekly, or monthly, depending upon your company's size and the volume of transactions. Don't think twice to look for help from an accountant or accountant if you locate handling your monetary records challenging. If you are trying to find a cost-free walkthrough with the Accounting Solution by KPI, contact us today.